Description

After designing your financing activities and developing implementation and evaluation plans, you are ready to assemble the financing resources you will need to implement your program (i.e., consumer outreach materials, contractor outreach materials, internal talking points, credit and rate support documents, and lender documents). The resources you create to implement your financing activities need to be developed in conjunction with those for your entire program.

At this point you have likely chosen to either:

- Promote an existing program or loan product

- Provide capital to help directly fund or enhance a loan product.

The specific resources you identify and develop will depend on which program design you choose, but will typically comprise the outreach, and loan support resources required to perform your financing activities.

Depending on the program design you have selected, you will need to develop resources that:

- Build awareness and trust in the loans your program is promoting or developing

- Allow you to perform the core functions of your program, including loan origination and servicing

- Raise the capital to fund loans or provide one of the many forms of a credit enhancement that will help you to meet your goals and objectives.

This handbook explains how to identify and develop the key resources that are needed to implement your financing activities. Three key steps are involved in developing your program’s financing resources:

- Hire and train staff needed to implement your financing activities

- Identify the resources needed to implement your financing activities, as laid out in your implementation plan

- Develop internal and external resources that conform to your program’s brand.

Step by Step

The resources you and your program partners develop are critical to the implementation of the financing activities your program chooses to perform. The following describes key steps to consider when identifying and developing resources related to your financing activities.

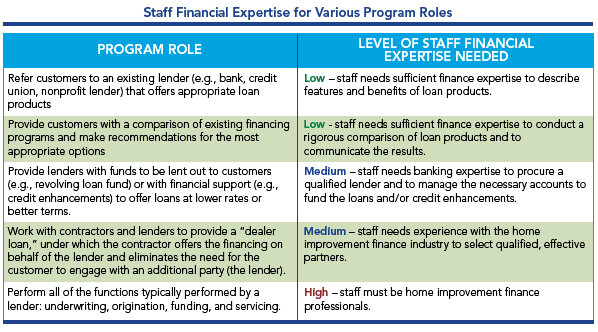

Having the right staff hired and trained is important for identifying and developing the resources you will need to implement your financing activities. Your implementation plan established staffing requirements and the roles and responsibilities of internal staff. The design decisions you made (i.e., promoting the financing activities of others, managing capital to fund loans or credit enhancements, or directly performing loan origination and servicing functions) will determine the level of staff financing expertise you need. A table summarizing the level of financial expertise recommended based on the role of your program is introduced in the implementation plans handbook, but presented here as well. Better Buildings Neighborhood Program partners have relied on a mix of staff and consultants to provide financial expertise.

The process for hiring and training your program’s staff will likely be handled at the programmatic level with input from your program’s financing lead, and address the staffing needs required to implement all of your program’s activities (e.g., Marketing & Outreach, Contractor Engagement and Workforce Development).

When making staffing decisions, consider the staff capacity of your lending partners, and your confidence that they have the skills and time to support you. Staff from your lending partners may be able to perform some of the functions that you would otherwise need to have covered by internal staff. Also, anyone who will talk to homeowners about your program’s financing offerings—whether it be internal staff, contractors or staff from your lending partners—should receive at least basic training on the key aspects of your loan products. This includes rates, terms, monthly payments, eligibility, and major steps in the loan process. Other stakeholders in your state that can help market your program’s loan offerings can also benefit from basic training. These stakeholders include utilities, Public Service Commissions, and energy efficiency advocates in your state or region.

If your program decides to use external partners to develop resources (e.g., fact sheets, contractor training materials, loan applications) you will need to procure their services. Depending on which role you choose for your program, you may be procuring the services of marketing and outreach firms, quality assurance inspectors, loan originators, servicers, etc. Procuring these resources may be as simple as a purchase order with a description of services or materials required or more complex procurement resources such as a request for proposals (RFP), request for information (RFI), or request for qualifications (RFQ). Be sure to comply with your organization’s procurement process requirements when developing these resources.

The specific resources required to implement your financing activities will depend on the role your program will fill. These resources can include:

- Outreach materials about available loan products for consumers

- Outreach materials informing contractors about those same products (other contractor documents are addressed in the Contractor Engagement & Workforce Development - Develop Resources handbook)

- Internal talking points about loan products and process for call centers, online help, and program staff and key outreach partners

- Lender documents.

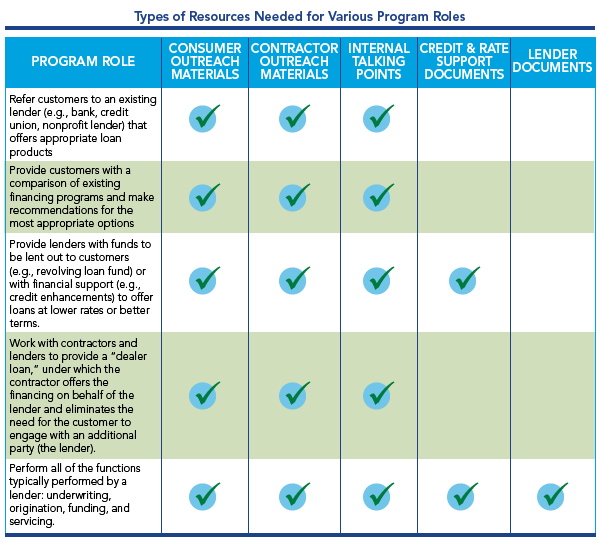

The following table identifies the types of resources typically needed for different program roles. Following the table are descriptions of each of the resource types. The Examples, Toolbox, and Topical Resources tabs of this handbook contain resource examples and supporting documents to help you identify and develop resources.

Consumer Outreach Materials

Having promoted and/or created a new home energy loan, you will need to inform homeowners in your community about it. Consumer outreach materials are a typical way to help drive loan uptake. These materials consist of promotional content that can be presented via the Web, bill stuffers, posters, pamphlets, fact sheets, videos, presentations, direct mail, telemarketing, etc.

Use these promotional materials to:

- Inform homeowners about the loan products you support or offer

- Explain features and benefits of the loan products

- Explain how consumers can access financing

- List important contacts.

Coordinate with your program’s marketing and outreach team and your lending partners to ensure that materials are informative and conform to your program’s brand, and content is presented clearly and concisely. Keep in mind that loans are a method to help homeowners pay for upgrades that result in multiple benefits (e.g., comfort, cost savings, increased home value, etc.). Selling homeowners on these benefits will be what drives uptake of home energy upgrades; details about your loan product should be presented as a way for homeowners to achieve these benefits.

Contractor Outreach Materials

For most programs, contractors have the most direct relationship with homeowners since they are the ones entering and working in their homes. To be successful, programs must work with their contractor partners to integrate financing into the energy efficiency sales process to avoid having financing become another complicated decision point for customers. This can include helping to develop promotional, educational, and training materials about available loan products and processes that can be presented via the Web, pamphlets, fact sheets, presentations, direct mail, telemarketing, etc.

If contractors are going to be selling home energy upgrades as part of your program design, these materials will need to be used to:

- Train contractors to promote and sell your program’s loan products and resources to homeowners (training can occur as part of the program orientation and/or through ongoing contractor meetings you provide). Training should involve role playing so contractors practice with your materials

- Help contractors highlight the benefits and features of financing options for their customers

- Train contractors on the systems and processes required to process loans and receive payment, as part of the program orientation and/or through ongoing contractor meetings

- Help contactors answer questions they may have (e.g., who contractors should call if a homeowner has a question they can’t answer).

See the Contractor Engagement & Workforce Development – Develop Resources handbook for more information about developing materials for contractor partners.

Contractor Outreach from Austin Energy

In October 2010, Austin Energy rolled out its single-family residential energy "Best Offer Ever" promotion, a three-month special that combined rebates and no-interest loans for energy upgrades. Austin Energy offered extra contractor training on the financing to drive sales during the promotion.

Once draft promotional plans were in place, Austin Energy hosted a breakfast meeting—getting on their Home Performance with ENERGY STAR contractors’ schedules before they were out in the field for the day—to discuss plans over tacos and coffee. Contractors provided feedback on the launch plans, received sample forms, and were trained on how to use them. The contractors were also candid about their involvement in implementing the offer. Most contractors had not actively marketed financing options before, so Austin Energy walked the group through each party’s role and responsibility in the loan process.

Austin Energy also scheduled the promotion during the fall and winter, which is typically a slow season for building contractors in otherwise sunny and hot Texas—increasing the likelihood that projects would be completed in a timely manner while also helping contractors avoid seasonal layoffs. As a result of the promotion, a total of 568 participants received Home Performance with ENERGY STAR upgrades through 47 contractors in six months—more than 10 times Austin Energy's typical participation rate.

Internal Talking Points

All members of your program team who have contact with homeowners (e.g., internal staff, call center staff, online help staff, lenders, and contractors) should be knowledgeable about your program’s loan products and the process to apply for and receive a loan, so they are prepared to answer questions from homeowners. FAQ documents and training sessions (in-person or via web conference) are effective methods to share information with your team members.

Loan product and process details to cover include:

- Loan options

- Loan rates and terms

- Borrower eligibility

- Eligible home upgrade measures

- Loan process (steps, documents, timeline).

Credit & Rate Support Documents

If your organization chooses to use funds to subsidize interest rates, provide a credit enhancement (e.g., loan loss reserve), or provide subordinate capital, you will need both process documents and agreements to establish your partnerships (discussed in the Financing-Identify Partners handbook). If your program doesn’t have internal expertise, you will require the services of a law firm specializing in financial agreements. You will need documents that include lender participation requirements, origination and servicing guidelines, and the rules and process flow for funding buy-downs, loan loss agreements, and/or subordinate capital.

Lender Documents

If your program chooses to become a direct consumer lender—managing underwriting, origination, funding, and servicing of loans in-house —most states will require you to acquire the appropriate license. If this is a role you are filling, the first step is to meet with your state’s banking commission staff and present your plans. Depending on the outcome of that meeting, you may require consultation with a banking compliance attorney to develop your application and proposal. You will also need to procure consumer-lending infrastructure from a technology firm that can provide origination documents, and you may want to consider contracting with a service bureau to subservice your loans.

Even if you are not serving as the lender yourself, set up a meeting with your lender to make sure their materials are ready and available before launching your program. Also, explore opportunities to co-brand their documents with your program to help create a unified brand for homeowners.

Examples of Lender Documents You Will Need to Develop

The following are examples of the types of documents you will need to develop if your program chooses to become a direct consumer lender:

Loan Origination Documents

- Loan application—a form that collects individual information from the applicant.

- Proof of homeownership—a form containing information that proves home ownership (such as title or tax payment form).

- Proof of income—a form containing information that proves income from an employer.

- Underwriting guidelines and forms—documents used by the underwriter to collect and analyze the creditworthiness of each applicant.

- Legally required disclosures—documents listing disclosures required by the state or federal government.

- Collateral identification and certification—a form that identifies and certifies the collateral used to secure the loan.

- Loan agreement (the “note”)—the legal contract obligating the borrower to repay the debt.

- Payment schedule—a document listing the terms of the loan and when payments must be made.

- APR calculation—the text that complies with truth in lending regulations by describing the cost of the debt.

- Additional closing forms—any documents or forms required to “close” or execute the loan.

- Approval letter—a letter sent by the lender to the applicant, informing them that they have been approved for a loan.

Servicing Documents

- Servicing welcome letter and subsequent letters—letters sent by the lender to new borrowers.

- Monthly statements or invoices for borrowers – details payments owed by borrowers and process for submitting payment.

- Collections letter—a letter sent by the lender to delinquent borrowers.

- Bankruptcy filing—forms to capture the details of borrowers that file for bankruptcy protection.

Investor Documents

- Uniform Commercial Code (UCC) filings—documents filed to protect lenders under the UCC.

- Blanket UCC filing for investors—documents evidencing group filing of UCCs for the benefit of an investor.

- Loan assignment letter for investors—a document assigning a loan or loans to an investor.

Contractor Documents

- Contractor quote (scope of work)—a document used to capture information from the contractor on the proposed installation and price.

- Contractor completion certificate—a certificate signed by the borrower asserting that the installation was performed in an acceptable manner.

- Issue filing—a form that captures a borrower’s assertion or claim of issues related to the installation.

After you have identified the appropriate resources to implement your financing activities, you need to decide whether they will be developed in-house, by your lending or contractor partners, or by some other external organization. The primary factors influencing this decision are the internal resources and staff expertise your program has available. You will likely be able to develop any required consumer outreach materials, internal talking points, and contractor outreach materials internally, but credit and rate support documents and lender documents will more than likely need to be developed externally. Regardless of who develops your resources, make sure you identify the people on your team who will receive the resources for distribution or collect resources once completed. Consider including these roles, responsibilities, and processes in your implementation plan.

Work closely with your lending and contractor partners on public-facing resources—their buy-in is important and they may be able to create some of the materials. Be sure that public-facing resources (e.g., fact sheets, presentations, Web content, videos) conform to your program’s brand (see Marketing & Outreach-Develop Resources for information on branding materials consistently), and that all resources you develop are used to help achieve your program’s financing goals and objectives.

Tips for Success

In recent years, hundreds of communities have been working to promote home energy upgrades through programs such as the Better Buildings Neighborhood Program, Home Performance with ENERGY STAR, utility-sponsored programs, and others. The following tips present the top lessons these programs want to share related to this handbook. This list is not exhaustive.

Many programs struggle with communicating the value of financing to homeowners. Financing can be a complicated topic, and ensuring that homeowners understand how their loans work and the benefits they will realize is important for converting interest into action. Many Better Buildings Neighborhood Program partners achieved success by simplifying messages, focusing on those that convey long-term value, low monthly payments, low interest rates, enhanced home comfort, and energy savings.

- The Keystone Home Energy Loan Program (Keystone HELP) found that “Low Monthly Payments” and “No Money Down” were effective messages to help drive loan uptake. They also advertise that homeowners will not encounter any surprises down the road. For example, the program website states, “Keystone HELP offers True Fixed Rate Financing, which means the rate of your loan will never change, and your low monthly payment will stay the same for the life of your loan.” This gave homeowners confidence that their monthly payments would be stable, and encouraged homeowners to make a larger investment in energy efficiency improvements to their home. As of October 2013, the program has provided more than $100 million in financing to over 11,000 Pennsylvania homeowners for energy efficiency home improvements.

- Enhabit's, formerly Clean Energy Works Oregon, messaging around financing focuses on affordability, home transformation, home comfort, home health, and proven results. For example, their website includes statements such as:

- “It has never been more affordable to transform your home from vintage looker to cutting edge performer.”

- “Hundreds of other homeowners have already financed a CEWO Home Energy Remodel, with costs ranging from $2,000 and $30,000 and an average just over $10,000. In most cases the money they save helps offset a nice chunk of the monthly loan payment.”

- “We think that’s a pretty good deal for a more comfortable, healthier, and energy efficient home.”

Enhabit couples its messaging with a simplified loan process and provides sample estimates of monthly loan costs and expected energy savings so homeowners can readily make informed decisions about the costs of their upgrade and expected savings in terms of monthly cash flow.” Between March 2011 and December 2013, Enhabit, through lending partner Craft3, completed more than 2,600 loans valued at $33.4 million, with an average loan amount of $12,500.

- When speaking with homeowners considering upgrades, Boulder County, Colorado’s EnergySmart program focuses on the messages that upgrades are a path to homeowner benefits, such as comfort, health and safety, and reduced energy bills. They also focus on how financing can be combined with available rebates to make upgrades financially attractive to homeowners. For example, their website states, “Energy Loans can help you achieve a more efficient, comfortable and affordable home. Interest rates start as low as 2.75%. Loans can be paid in part or in full with zero prepayment penalties. Energy Loans can be combined with rebates to fully fund your home upgrades.” By simplifying messages and the loan process, in conjunction with energy advisor support, Boulder County was able to achieve conversion rates of greater than 70%. Between October 2010 and September 2013, EnergySmart was designed, launched, and supported the completion of upgrades in more than 4,100 homes. Over $1.7 million in energy loans were issued by EnergySmart between August 2012 when the loan product became available and September 2013, helping 150 homes and businesses overcome cost barriers to energy efficiency investment.

Resources

The following resources provide topical information related to this handbook. The resources include a variety of information ranging from case studies and examples to presentations and webcasts. The U.S. Department of Energy does not endorse these materials.

This case study describes Austin Energy's short-term, comprehensive rebate/financing offer to jump-start participation and valuable lessons learned along the way.

This policy brief provides insight into the transaction of an on-bill energy efficiency loan portfolio between two mission-oriented lenders, Craft3 in Oregon and Self Help in North Carolina.

Presents the loan loss reserve guidelines for the Arkansas Residential Energy Efficiency Loan Loss Reserve Program.

This plan presents the marketing education and outreach plan for Energy Upgrade California's financing pilots.

This form is used to itemize energy conservation measures as an eligibility requirement under Efficiency Maine's Home Energy Savings Program.

Lists a number of resources related to Michigan Saves, including contractor application, home energy loan implementation guide, and training presentations for residential contractors.

Example credit application from Fayette County Better Buildings.

Summary of minimum standards and requirements for the Massachusetts HEAT Loan program.

Fact sheet that provides an overview of the Energy Impact Illinois Loan Program.

This packet contains all the contractor reporting and verification forms required by Energy Impact Illinois.

Table summarizing financing options for Colorado residents in EnergySmart Colorado territory.

Flier that summarizes energy efficiency financing offered by Xcel Energy's financing partners.

A sample competitive procurement procedure to award loan loss reserve funds to a financial institution partner.

A sample RFP from Greensboro, North Carolina, for energy efficiency loan products.

Because of its potential to reduce customers’ first costs and leverage private funds, financing has been increasing in importance as a strategy for facilitating energy upgrades as program administrators seek to meet ambitious goals in a shifting energy efficiency landscape. This paper evaluates the experience of BBNP grantees to identify how programs can most effectively integrate loan offerings into their broader efforts to promote energy efficiency upgrades. The paper also identifies best practices from grantees’ experience related to integrating financing into program outreach and trade ally interactions.

Presentation describing NYSERDA's alternative underwriting approach for its target market.

This presentation provides an overview of the Energy Savers program for affordable rental housing, its loan structure, and lessons learned.

A template competitive procurement procedure to award loan loss reserve funds to a financial institution partner.

A template agreement demonstrating how to address the deposit and use of loan loss reserve funds.

A template agreement that addresses the full energy efficiency or renewable energy loan origination cycle.

The Better Buildings Financing Navigator is a web-based tool designed to help private and public sector organizations discover financing solutions for energy efficiency projects that meet their unique needs. Through the Financing Navigator, multi-family building owners, facility and energy managers, and other decision-makers can connect with financiers, including banks and financial institutions, to pursue energy-saving measures.

The Small Town Energy Program (STEP) toolkit gives a complete overview of STEP from planning to implementation. It also includes access to a wide variety of materials developed by the program, including: local asset materials, partner materials, personnel materials, program administrative materials, outreach materials, and surveys. STEP has posted these toolkit documents with the hope that it will assist other small towns and communities in building and running more energy efficiency programs.

Energy Efficiency and Conservation Loan Program Webinar Series: #1 Overview and Cost Effectiveness

This webinar is the first (in a series of six) hosted by USDA Rural Utility Service (RUS) and focusing on the Energy Efficiency and Conservation Loan Program (EECLP). This webinar provides an overview of the Energy Efficiency and Conservation Loan Program. It covers the requirements and benefits of the program and also discusses steps you can take to evaluate the cost effectiveness of energy program options.

Energy Efficiency and Conservation Loan Program Webinar Series: #5 On-Bill Financing

This webinar is the fifth (in a series of six) hosted by USDA Rural Utility Service (RUS) and focusing on the Energy Efficiency and Conservation Loan Program (EECLP). This webinar focuses on financing energy improvements on utility bills and features case studies about Roanoke Electric Cooperative's Upgrade to Save program and North Arkansas Electric Cooperative. It also provides information for programs seeking on-bill financing project assistance.

This website provides an overview of financing as it pertains to state, local, and tribal governments who are designing and implementing clean energy financing programs. Residential financing tools include residential PACE (R-PACE), on-bill financing and repayment, loan loss reserves and other credit enhancements, revolving loan funds, and energy efficient mortgages.

This U.S. Environmental Protection Agency resource is intended to help state and local governments design finance programs for their jurisdiction. It describes financing program options, key components of these programs, and factors to consider as they make decisions about getting started or updating their programs.