Description

The foundation of a successful residential energy efficiency program is a clear set of goals and objectives that will guide program design and implementation activities. These disciplines will help you design your loan products, communicate the value of your efforts to key audiences, and guide decisions about the approaches you use to integrate your financing activities within your residential energy efficiency program.

Your program’s goals will serve as a starting point from which you will develop specific financing objectives. Use the information collected during your market assessment and program design activities to align your financing objectives with overarching program goals.

The overarching goals of residential energy efficiency programs often include helping homeowners and households lower their energy use and costs, while improving the health, safety, and durability of their home through installation of energy efficiency measures by qualified contractors. Providing financing that is accessible and affordable can:

- Increase your program’s total completed upgrades by removing barriers to up-front project costs

- Help your program serve a wider income demographic, including low to moderate income households

- Achieve more comprehensive upgrades with multiple improvements and greater energy savings per home

- Enable completion of measures with longer pay-back periods, in addition to those with shorter pay-back periods

- Leverage private capital, supporting program sustainability

- Attract contractors and increase their customer base

- Compliment utility rebate programs, when possible.

Financing program objectives typically include the following areas:

- Loan processing times: Efficient turn-around times for loan processing, including straightforward applications, fast loan close times, fast contractor payments upon project completion or as progress payments during the project

- Participation: High levels of customer applications and approvals and contractor participation

- Clarity: Loan product features are clear to both contractors and homeowners

- Loan product features: Attractive interest rates, long fixed rate loan terms, and minimal up-front fees

- Loan defaults: Low percentages of loan defaults and loan charge-offs

- Recapitalization strategy: If funding loans directly, identifying options for recapitalizing the loan fund. One option is to sell the portfolio to home improvement loan investors and use the proceeds to fund new loans. To facilitate such a sale, the loan product should set underwriting requirements (e.g., FICO, debt to income ratios) and terms (e.g., min/max loan amount, maturities, interest rates) that are familiar and acceptable to home improvement loan investors.

Three key steps are involved with establishing financing objectives that will meet the needs of your residential energy efficiency program:

- Review program goals

- Set financing objectives that tie to your program goals. These should be clearly defined, measurable, and achievable by a realistic date. Your financing program objectives should be matched to your market needs and your program’s available resources

- Reach out to stakeholders. Use stakeholder input to refine your objectives and gain greater support for your efforts.

Having established financing objectives, you will be ready to move forward with the design and implementation of your financing activities, and set the basis for the evaluation of your financing activities. By thinking specifically about what program success looks like in your community, you will also have created an opportunity to identify, account for, and overcome possible barriers to program success, such as homeowners’ lack of access to capital, lack of consumer demand for your program services due to unaffordable financing options, or homeowners not meeting lenders’ qualifying criteria (e.g., minimum credit score).

Step by Step

After assessing the market to identify your target audience for financing energy efficiency upgrade measures, your next task is to define your finance activity objectives. These should be clearly defined, measurable, and achievable by a realistic date.

The following are the three key steps for establishing objectives for your financing program:

Establish or refine specific financing goals, objectives, targets, and timeframes

Program goals identify what your program aspires to accomplish over the long term. These goals may vary from program to program depending on community needs, organizational mission, program budget, and other factors. Most energy efficiency programs have goals related to saving energy and saving customers’ money.

The purpose of your financing activities is to support your overarching program goals. You will want to review these program goals to determine a vision for how your financing activities can help meet them. Using that vision, you will be ready to develop specific financing objectives.

After reviewing your overall program goals, develop financing objectives that tie into them. Objectives are specific, measureable, achievable, relevant, and include a timeframe. They specify targets for how you will achieve your goals.

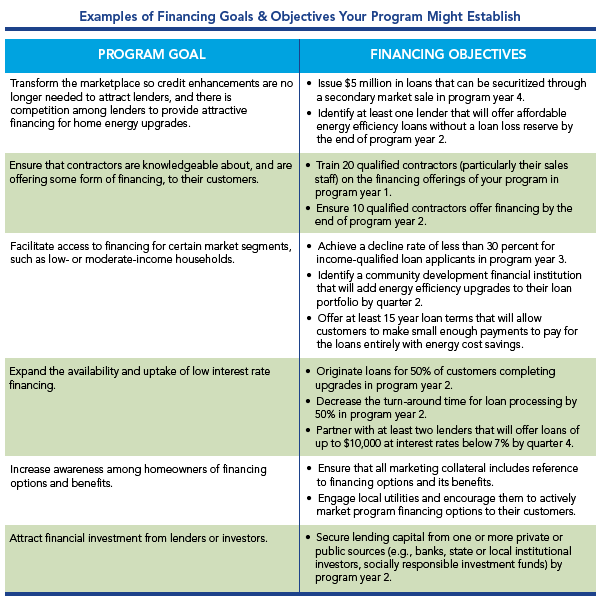

Establishing your financing strategy’s objectives will help guide the design of your financing activities. Financing objectives that complement program goals could reduce the need for program funds to serve as loan capital, facilitate access to financing for certain market segments, or expand the availability and uptake of low interest financing. The following table presents examples of financing objectives that tie into program goals.

You may also want to consider a set of secondary financing objectives that support other components of your program. For example:

- Goal: Build brand awareness:

- Objective: Generate interest in your energy upgrade program by helping one of your lending partners to integrate your program’s materials into its loan marketing by quarter 3.

- Goal: Enhance contractor sales:

- Objective: Expand the skills and knowledge of contractors in selling home energy upgrades and financing by providing classroom and role play training on financing options for at least 10 contractors by quarter 1.

As you decide upon your financing objectives, make sure you have a way to measure progress toward each. You may need to revise or change your objectives over time. Programs often have to make adjustments based on valuable customer and community feedback.

Reaching out to potential program partners and stakeholders can help you refine your financing strategy objectives. Stakeholders can include municipal governments, residential energy efficiency program sponsors, contractors and trade allies, lenders and potential investors, electric and gas utilities, universities, community action groups, and other non-governmental organizations.

Working with stakeholders may help strengthen your program’s credibility, support effective integration of the loan program with home energy upgrade activities, and enhance the attractiveness of the loan program in the marketplace.

Learn more about the roles and potential impact of financing partners and stakeholders in Chapter 6 of DOE's Clean Energy Finance Guide for Residential and Commercial Building Improvements, “Partners & Stakeholders: Roles and Potential Impact."

The Benefits of Stakeholder Buy-In

Michigan Saves developed a statewide network of more than 20 partners and stakeholders, including municipalities, utilities, energy professionals, lenders, trade associations, universities, and community action groups that contributed first-hand knowledge and expertise to help devise program design and implementation strategies, and ways to generate excitement for their program within Michigan.

With the help of stakeholders, Michigan Saves staff conducted research that found that observed losses (i.e., write-offs of unpaid loans) on energy efficiency-related loans from around the country ranged from 1% to 4%. With this knowledge, Michigan Saves was able to leverage public funding to attract loan capital from its private financial partners at a ratio of 20:1. Michigan Saves also worked with its participating lenders and contractors to develop an efficient method for approving and funding loans—a critically important part of an effective financing program.

Michigan Saves was also able to motivate its partners to provide free marketing, outreach, and measurement and verification services by showing them how this program would serve their own goals. As Michigan Saves has demonstrated, key stakeholders in the community can provide valuable insight into how a program can effectively use public funds to address the needs of the community.

Tips for Success

In recent years, hundreds of communities have been working to promote home energy upgrades through programs such as the Better Buildings Neighborhood Program, Home Performance with ENERGY STAR, utility-sponsored programs, and others. The following tips present the top lessons these programs want to share related to this handbook. This list is not exhaustive.

Many program administrators have found that launching and scaling up a program often takes longer than planned for, especially when forming partnerships with contractors and lenders. New energy efficiency programs often need at least 2-3 years to launch and become fully operational. Across programs, the amount of time it takes to get to full operations depends on many factors, including the number of qualified contractors working in the area, the availability of funding, the level of stakeholder and partner support that is available, the program’s goals and strategies, and the presence of unique program features that may take time to develop, such as community workforce agreements or loan products. Many program administrators found it helpful to set realistic expectations internally—and with key partners and stakeholders—about how long it takes to get programs fully up and running. And, they suggest celebrating and communicating achievements along the way.

- emPowerSBC in Santa Barbara, California, found that launching its program and scaling up took more time than expected. The launch of the program was delayed more than a year as the program modified its financing strategy from one that relied on residential PACE to one focused on a loan-loss reserve. Following the launch, hiring delays kept the program from being fully staffed for around six months. Contractors working with the program reported that it took three to twelve months for a lead to turn into a signed contract for upgrade services because homeowners took their time deciding whether to invest in energy efficiency.

- The Virginia State Energy Program (SEP) found that it was difficult for its three programs around the state—the Local Energy Alliance Program (LEAP), the Richmond Region Energy Alliance, and Community Alliance for Energy Efficiency (Cafe2)—to meet their upgrade targets in three years because the home performance industry in the state was still developing when the programs were initiated. These in-state programs started with little to no infrastructure in place and had to address barriers such as lack of qualified contractors before they could even begin offering home energy upgrades. For example, the programs found that contractors were reluctant to modify their business models and agree to undertake the paperwork and data collection the programs required. Over time, the programs developed strategies to work more effectively with contractors, such as holding monthly contractor meetings (in the case of LEAP) and establishing written Memoranda of Understanding with contractors to clarify mutual expectations (in the case of Cafe2). Virginia SEP advised that programs’ goals and timelines should reflect the starting conditions and the work that needs to be accomplished in order to achieve program goals.

- Enhabit, formerly Clean Energy Works Oregon, began with modest goals for a pilot project in Portland and then ramped up its ambitions as it expanded statewide. The goals for the program’s pilot project were to upgrade 500 homes in Portland, build a qualified workforce, and test its approach to service delivery. After the pilot, the program expanded to all of Oregon and upgraded over 3,000 homes around the state in three years.

Resources

The following resources provide topical information related to this handbook. The resources include a variety of information ranging from case studies and examples to presentations and webcasts. The U.S. Department of Energy does not endorse these materials.

With project funding from Energize NY PACE and incentives from NYSERDA's Multifamily program, Natlew Corporation was able to make energy efficiency upgrades to their multifamily affordable housing complex in Mount Vernon, NY.

This summary from a Better Buildings Residential Network peer exchange call focused on how loan performance data is tracked and analyzed, and what the data shows.

Provides a framework for designing a financial program that accounts for market needs and barriers to success.

The Better Buildings Financing Navigator is a web-based tool designed to help private and public sector organizations discover financing solutions for energy efficiency projects that meet their unique needs. Through the Financing Navigator, multi-family building owners, facility and energy managers, and other decision-makers can connect with financiers, including banks and financial institutions, to pursue energy-saving measures.

The Financing Program Decision Tool is for state and local governments just starting their clean energy financing programs. The tool provides information on the different types of financing available and helps users identify the best options for their program.

Finance Planning

This report lays the groundwork for a dialogue to explore regulatory and policy mechanisms for ensuring that efficiency financing initiatives provide value for society and protection for consumers. Through case studies of Connecticut, New York, Massachusetts, California, and Maryland, it explores emerging issues that jurisdictions will need to tackle when considering an increased reliance on financing.

This report provides an overview of the current state of on-bill programs and provides actionable insights on key program design considerations for on-bill lending programs.

Residential Property Assessed Clean Energy (R-PACE) -- A Primer for State and Local Energy Officials

This website provides an overview of financing as it pertains to state, local, and tribal governments who are designing and implementing clean energy financing programs. Residential financing tools include residential PACE (R-PACE), on-bill financing and repayment, loan loss reserves and other credit enhancements, revolving loan funds, and energy efficient mortgages.

This U.S. Environmental Protection Agency resource is intended to help state and local governments design finance programs for their jurisdiction. It describes financing program options, key components of these programs, and factors to consider as they make decisions about getting started or updating their programs.

This publication outlines capital leveraging models and examples from across the country in which public funds were used to influence energy loan program capital.