Description

Before designing your program, assess the market to help inform your decisions about your target audience, what services to provide, and how best to deliver those services. Don’t assume that you know what your market needs and what motivates your customers. You, after all, are most likely not your program’s target audience. Instead, do your homework to fully understand your market and craft your program to fit the specific needs and opportunities in your community.

This handbook provides an overview of market assessments and links you to more detailed information about assessing specific components of your program, including information sources and strategies for data collection. It then helps you integrate information into an overall understanding of the market and your options for program design.

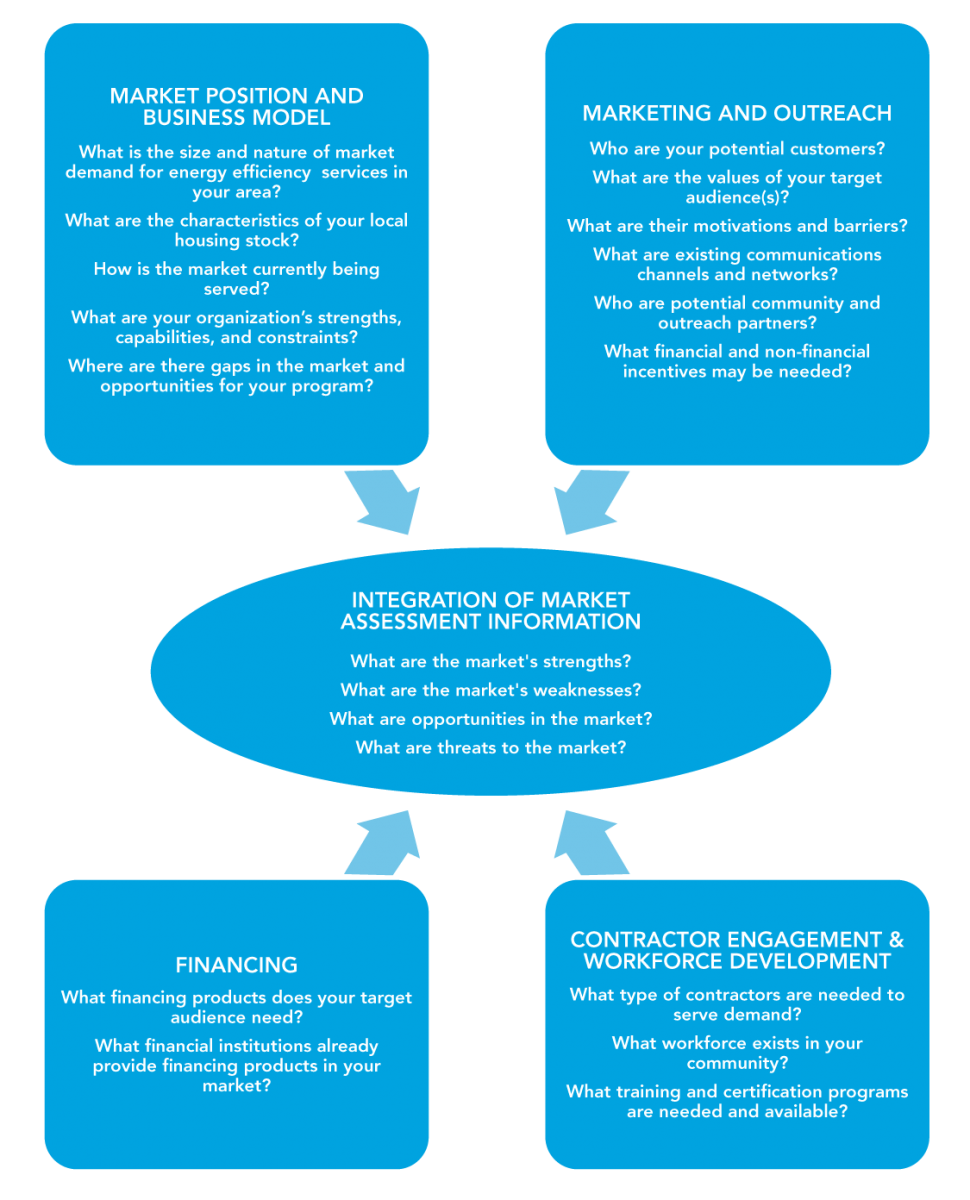

A thorough assessment involves specific assessments of:

- The market in which your organization operates, including existing federal, state, and local policies that encourage or discourage residential energy efficiency and what other programs or market actors are providing energy efficiency services. This assessment identifies gaps in the market and opportunities for your program. You can find more information about this aspect of market assessment in the Market Position & Business Model Assess the Market handbook.

- Information about potential customers, the barriers they face, and what types of marketing and outreach will help encourage them to pursue upgrades. You can find more information about this aspect of market assessment in the Marketing and Outreach Assess the Market handbook.

- Your potential customers’ opportunities and needs for financing. You can find more information about this aspect of market assessment in the Financing Assess the Market handbook.

- Information about the availability and skills of local contractors to do upgrade work for your potential customers. You can find more information about this aspect of market assessment in the Contractor Engagement & Workforce Development handbook.

Illustration of Key Content of an Integrated Market Assessment for Program Design

Market assessment is essential before you begin making program design decisions. It will help you craft a program that fits the particular opportunities, needs, and barriers to home energy upgrades in your community and help you with critical design decisions, including:

- Customers to whom you will offer products and services

- Products and services your program will provide

- Mechanisms to deliver products and services to your customers.

Key steps for assessing the market, covered in this handbook, are:

- Understand market demand, local policies, and building stock

- Assess your potential customers’ motivations for home energy upgrades

- Assess your potential customers’ needs for loans and other financial products

- Assess your local contractor network and workforce development resources

- Analyze program strengths, weaknesses, opportunities, and threats (SWOT) to inform design

Step by Step

Assessing the market to inform your program design decisions involves steps to gather and integrate information about components of your program and market position.

As you go through these steps to assess your market, make sure you take the opportunity to identify stakeholders and potential partners that can help you understand your market, potential customers, and program opportunities.

Identify options for program focus and scope based on market needs, opportunities, and challenges

When you design your program, your decisions about target audiences, services, and delivery channels should be informed by your organization’s position in the market and consistent with your organization’s business model. For example, if your organization is seeking to fill a gap in the market for moderate income, suburban homeowners, the types of services you offer and how you deliver them to these homeowners will be quite different than if you are focusing on urban, multi-family buildings.

As described in greater detail in the Assess the Market handbook for Market Position and Business Model, a market assessment to help your organization define its market position and business model includes gathering information on:

- The nature of market demand for residential energy efficiency products and services, including factors such as:

- Policies and programs in your area that encourage or discourage energy efficiency

- Characteristics of your local housing stock

- Energy prices

- Community initiatives on residential energy efficiency or other sustainability issues

- Availability of federal or state tax credits for residential energy efficiency

- How the market is already being served by other organizations and what gaps exist

- Your organization’s strengths, capabilities, and constraints in providing needed products and services in the market.

BetterBuildings for Michigan Community Readiness Assessment

In 2010, Better Buildings Neighborhood Program partner BetterBuildings for Michigan launched a residential energy efficiency program across Michigan. To begin gauging community readiness, Michigan assessed various community factors. For example, the program asked community partners to gather petition signatures from residents who were interested in bringing an energy efficiency program to their town. The number of signatures gathered provided information on how interested the community was in an energy efficiency program and the partners’ ability to organize the community. Through efforts like these, Michigan developed and used a “readiness scale” to help determine which communities would be most receptive to a residential energy efficiency program. In addition to the volume of signatures on petitions, the program identified several key factors that were important to gauging a community’s readiness:

- Existing community communication networks, such as a local paper, newsletters, and word of mouth

- Presence of a credible and passionate messenger

- A community’s exposure to and knowledge of energy efficiency

From its experience, BetterBuildings for Michigan developed the Community Sweep Tool Kit, as well as a community readiness assessment tool within its Actioniirs Web app, which helped program organizers gather information from community members.

An understanding of federal, state, and local policies is of particular relevance for program design because they may create or constrain opportunities for your program. Policies such as utility bill disclosure or energy assessment requirements may help create demand for residential energy efficiency products and services for particular segments of your market. Your program may also be impacted directly by policies or regulation—for example, if you are running a program as a regulated utility—which will influence or constrain the services you can offer and to whom.

At this stage of program design, you need to have a thorough understanding of your community’s building stock and energy supply, which will give you a sense of areas of your community and types of buildings on which to focus. Use this knowledge to help you understand the types of upgrade measures that will save the most energy and money for local homeowners, building owners, and tenants. Your organization may have already done such an assessment as part of the development of its business model, but this is still a good time to make sure you understand the following key characteristic of the built environment in your market:

- Building types (e.g., single family homes, site built or manufactured, rental or owner-occupied small or large multifamily buildings, mixed use buildings, buildings in historic preservation communities, and manufactured housing) and their energy consumption

- Typical age of buildings, style, condition, and type of construction and materials (e.g., brick, masonry, wood frame, etc.)

- Age and type of heating (including fuel types) and other major equipment and appliances

- Typical household energy costs.

Useful sources of information for assessing building stock, energy use, and community demographics are listed below:

National sources:

- U.S. Energy Information Administration state profiles, which provide state level data and analysis on energy use by source

- U.S. Department of Energy Buildings Energy Data Book, which provides statistics on residential and commercial building energy consumption

- U.S. Energy Information Administration Residential Energy Consumption Survey, which provides information on the U.S. housing stock, including energy consumption data

- The American Housing Survey, (sponsored by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development), which provides current data on a wide range of housing and demographic characteristics

- U.S. Department of Energy Buildings Performance Database, which allows users to performance statistical analysis of energy use and energy savings for various building types based on actual building performance data

- The Census Bureau’s American Community Survey, which provides information on income and other community demographics

- The Joint Center for Housing Studies at Harvard University, which produces several reports on the U.S. housing stock

State and regional sources:

- State energy offices and state public utility commissions, which have data on energy use in your state, by sector

- Utilities, which often conduct studies of potential savings from residential energy efficiency in their service areas

Local sources:

- State & Local Energy Data, a tool developed by the U.S. Department of Energy, which presents energy market information by zip code as well as a cataloged, customizable list of actions to help local communities make strategic energy decisions.

- Your local government or colleges or universities in your area, which may have information about recent local housing surveys

- Local tax assessor records

- Local real estate market data and information from remodeling contractors, which can provide insights into the willingness of homeowners to make home investments

Environmental Finance Center at the University of North Carolina at Chapel Hill Housing Assessments

The Environmental Finance Center (EFC) at the University of North Carolina at Chapel Hill conducted market assessments in the five jurisdictions below to better target these programs’ strategies and designs:

- Sarasota County Energy Efficiency Upgrade Financing Program: Market Assessment

- City of Greensboro Better Buildings Project: Market Assessment

- St. Louis Residential Energy Efficiency Loan Program: Market Assessment

- CharlestonSAVES: Market Assessment

- Alabama Energy Revolving Loan Fund: Market Assessment

The EFC examined the year of home construction, total square feet of homes, types of heating systems, and fuel for heating and cooling. Based on this analysis, the EFC recommended areas of the city (by zip code) and types of homes (e.g., natural gas heated) on which programs should focus. The assessments also suggested what types of upgrade measures garner the highest energy and costs savings.

Once you have identified opportunities for energy and cost savings in your community, you need to know who your customers are and what will motivate them to pursue home energy upgrades. For example, your assessment of the local building stock may indicate an opportunity to upgrade older homes in several neighborhoods where the houses are served by oil heat. What do these homeowners need and value? If you find that they most value increased comfort and reduced heating costs, your marketing strategy should show them how home energy upgrades can heat their homes at lower cost. You may also want to design your program around air sealing, insulation services, and heating system upgrades (e.g., transitioning from oil to electric heat pumps).

Different segments of your customer audience will have different issues, concerns, barriers, and values that influence their needs and interest in home energy upgrades. As described in greater detail in the Marketing and Outreach Assess the Market handbook, an assessment of these potential customers and their communities will allow you to identify:

- Consumer values

- Demographics (e.g., families with young children, health awareness or concerns, energy bills relative to income)

- Existing communications channels and networks

- Potential community and other outreach partners.

The analysis will also help you understand customers' motivations and the barriers they face to residential energy efficiency upgrades. Your program design should seek to overcome these barriers. For example, customers may lack:

- Information from trusted sources about financial, comfort, health, safety, and other benefits of residential energy efficiency

- Information about what types of upgrades make the most sense for them

- Funds for the up-front investment in residential energy efficiency. For information on assessing customer’s financing needs, see the Assess the Market handbook for Financing

- Information about contractors that can do the work—or there may not be many contractors in the area that are qualified. For information on assessing contractors in your area, see the Assess the Market Handbook for Contractor Engagement & Workforce Development.

To understand financing opportunities and needs, identify the financial products currently available in the marketplace and whether additional financing options could help meet or support demand for residential energy efficiency upgrades. For example, your market assessment may reveal that a segment of your target audience already has sufficient access to affordable financing (e.g., through home equity lines of credit) or the ability to pay out-of-pocket, while another segment needs financing but has trouble qualifying for it under traditional underwriting standards. Your program could, for example, consider working with your financial partners to establish an alternative set of underwriting standards that takes other data points into account and can help some homeowners qualify for loans.

As described in greater detail in the Assess the Market handbook for Financing, assessing opportunities and needs for financing involves:

- Assessing the financial characteristics of your program’s target customers and determining whether existing financial products are available to help them undertake the kinds of efficiency upgrades that your program will offer

- Identifying financial institutions that provide loan or other products for home energy upgrades and understanding their products and potential limitations.

An assessment of your local contractor network and workforce development resources will identify the capacity of the current workforce and recruitment, training, or other needs to serve your market. An unqualified workforce may be a barrier that your program needs to overcome. For example, if you find that there are few contractors specializing in the types of services your community needs, your program should focus on training, certification, and possibly licensing. You may also need to put relatively more resources into quality assurance.

Your assessments of market position and target audiences will help you understand the opportunities for providing residential energy efficiency services and therefore your program’s needs for home performance contractors. As described in greater detail in the Assess the Market Handbook for Contractor Engagement & Workforce Development, a workforce assessment focuses on:

- Assessing the number and type of qualified home performance contractors in your local market with which you could partner to deliver your program’s products and services

- Evaluating the need for workforce training and certification to bring qualified contractors into the market

- Locating training and educational institutions in your community that could help develop the skills and qualifications of local home performance professionals to meet your program’s goals

- Identifying organizations that can help trained home performance professionals find jobs.

A thorough market assessment will generate a lot of information. Undertaking a SWOT analysis is a good way to integrate this information and start developing options for program design. "SWOT" stands for "strengths, weaknesses, opportunities, and threats."

To understand your market and opportunities for your program ask yourself:

- What are the strengths of the market, such as high customer awareness and interest in residential energy efficiency or an established contractor network?

- What are the weaknesses in the market, such as lack of financing or trained home performance professionals?

- What are the opportunities in the market, such as a set of customers that are interested in residential energy efficiency but are not able to access existing utility incentive programs or an opportunity to complement an existing program?

- What are the threats to the market, such as declining state or utility budgets for energy residential efficiency incentives?

This kind of analysis can help you:

- Focus your program (at least initially) on customers in the early adopter market segments where there is already strong demand for residential energy efficiency

- Increase capacity and opportunities where the market is weak

- Leverage existing opportunities through outreach and marketing

- Mitigate threats and build resiliency to potential changes in the market

- Identify what resources and skills your program may need and what services and business model are most appropriate for your market.

These insights from your market assessment will be further refined as you begin making program design decisions to craft a program that fits the particular opportunities, needs, and barriers to home energy upgrades in your community.

Tips for Success

In recent years, hundreds of communities have been working to promote home energy upgrades through programs such as the Better Buildings Neighborhood Program, Home Performance with ENERGY STAR, utility-sponsored programs, and others. The following tips present the top lessons these programs want to share related to this handbook. This list is not exhaustive.

Many programs that focused on a specific neighborhood or other small geographic areas have found it difficult to generate enough customer interest, partner interest, and upgrade activity to meet program goals. Regional or statewide approaches are often more attractive to contractors, lenders, utilities, and other partners than smaller markets defined by neighborhoods or city boundaries because they align with more typical service territories. Programs have found that larger contractors often are not interested in working in multiple cities or towns that have varying qualifications procedures and incentive rules. Utility partners are often better able to engage with a program offering services across a large segment of their customers. Historically, credit unions, community banks, CDFIs, and national lenders already specializing in energy efficiency loans have been more receptive to partnerships with residential energy efficiency programs.

- Be SMART Maryland shifted away from a volunteer-driven, neighborhood-by-neighborhood approach in favor of marketing through contractors and local community organizations to a broader geographic area. The program found it difficult to manage marketing and outreach to diverse geographic locations with the neighborhood approach (e.g., volunteer networks were difficult to engage and inconsistent from community to community). The adjustment in marketing strategy and target audience definition expanded Be SMART Maryland’s service area, proved to be more effective in generating interested customers, and made the program more attractive to qualified contractors.

- Community Power Works (CPW) in Seattle found that its geographic scope was too narrowly focused when it first began providing services. At that time, CPW was focused on specific areas of the city, including many low-income neighborhoods. These geographic boundaries limited the number of potential customers, and many residents in these areas did not have the financial ability to invest in energy efficiency upgrades or access financing. CPW achieved significantly higher results once it expanded its geographic scope to the entire city in early 2012, more than doubling the number of eligible households. The expansion of the service territory—along with other program changes, such as simplifying and increasing incentives and offering new financing options—significantly boosted the number of upgrades per month from around 10 per month in late 2011 to around 50 per month in mid-2012. For more information, see Seattle Community Power Works’ Fall 2012 Progress Report.

- Energize Phoenix, which focused its program on a central downtown light rail corridor, expanded its service area after a year of operations in late 2011 to increase the number of homeowners eligible for upgrades and unite neighborhoods that the previous boundaries had unintentionally divided. After the program launched, managers realized that the original program boundary, scaled down to better match funding amounts, divided close-knit neighborhoods and didn’t correspond to traditional media and market boundaries. The program found that it was hard to target its marketing and outreach only to residents in the service area without also reaching those ineligible for the program. Especially in tight-knit neighborhoods, this created discord over who qualified for the program and who did not. When the program expanded the service area in 2011 to cover entire neighborhoods, it increased its geographic area by 55% and increased the number of eligible residential parcels by 77%. This helped drive an increase in single family and multifamily upgrades in 2012 and 2013. After three years in operation, the program upgraded over 2,000 housing units. For more information on the program and the expansion of its service area, see Energize Phoenix’s Energy Efficiency on an Urban Scale, Year Three Report: Results.

- The New Hampshire Beacon Communities Project's original upgrade goals were based on the state’s Climate Action Plan and some general knowledge about the demographics of the three participating communities in the program. As the program began to unfold, however, the program noticed significant differences between the estimated number of projects and the actual level of demand. The projections were likely high because the original estimates were based more on need (i.e., how many buildings the state should upgrade), rather than an analysis of the existing market demand and potential for expansion. By the end of the grant period in 2013, a suite of efforts, including increased marketing and a statewide expansion of its residential program helped the program exceed its revised residential upgrade goals.

Resources

The following resources provide topical information related to this handbook. The resources include a variety of information ranging from case studies and examples to presentations and webcasts. The U.S. Department of Energy does not endorse these materials.

This U.S. Department of Energy Focus Series highlights the BetterBuildings for Michigan program’s community readiness assessment tool.

This market assessment for CharlestonSAVES identifies the customers and potential demand for an energy efficiency upgrade financing program.

This market assessment for the Sarasota County (Florida) Energy Efficiency Upgrade Financing Program identifies the customers and potential demand for an energy efficiency upgrade financing program.

This summary from a Better Buildings Residential Network peer exchange call focused on changes and trends in the market for home energy upgrades.

Homeowner survey created by the utility to inform their whole home upgrade program.

The Buildings Performance Database (BPD) is the largest national dataset of real building performance data, and enables users to perform statistical analysis on an anonymous dataset of hundreds of thousands of commercial and residential buildings from across the country. One of the most powerful applications of the tool is custom peer group analysis, in which users can examine specific building types and geographic areas, compare performance trends among similar buildings, identify and prioritize cost-saving energy efficiency improvements, and assess the range of likely savings from these improvements.

This resource, provided by DOE, presents energy market information to help state and local governments plan and implement clean energy projects. The resource also includes a local energy toolbox that provides a cataloged, customizable list of actions to help local communities make strategic energy decisions.

This report documents the results of an analysis of the electric end-use energy efficiency potential in the U.S. single-family detached housing stock. Technical and economic potential estimates inform the role that residential energy efficiency plays in addressing the objectives of reliable, affordable, and clean electricity for residential end uses.

This report represents NEEP’s annual assessment of the major policy developments of 2014, as well as its look into the immediate future, where NEEP gauge states’ progress toward capturing cost-effective energy efficiency as a first-order resource. While looking at the region as a whole, NEEP also provides summary and analysis of some of the biggest building energy efficiency successes and setbacks from Maine to Maryland — including significant energy efficiency legislation and regulations and changes in funding levels for energy efficiency programs.

Research reveals a whole range of unmet housing-related desires in America -- gaps between what Americans have and what they say they need or want. The Demand Institute surveyed more than 10,000 households about their current living situation and what’s important to them in a home. The survey represents all U.S. households: renters and owners; movers and non-movers; young and old and finds that unsatisfied needs and desires cut across the entire population.

The primary objective of the quantitative research phase of this survey was to get market-based feedback and insights in the following areas to assist the industry in better serving its constituents, including: insights as to major challenges that industry is facing and potential support that organizations could provide and feedback on how industry organizations could add value for constituents in the future.

The Southeast Energy Efficiency Alliance (SEEA) has prepared this assessment of the Southeast’s multifamily sector to better understand the current stock of multifamily units; regional and state multifamily construction trends; utility multifamily energy efficiency programs; and state and local policies and programs focused on the multifamily sector.

This report updates ACEEE's 2013 assessment of multifamily energy efficiency programs in US metropolitan areas with the most multifamily households. Using housing, policy, and utility-sector data from 2014 and 2015, this report documents how these programs have changed in the context of dynamic housing markets and statewide policy environments. The report also offers an analysis of the number, spending, offerings, and targeted participants of current programs and their potential for further expansion.

This paper describes the current state of energy efficiency financing, highlighting what is and isn’t working, while offering a look at the future of the industry.